The Definitive Guide on How to Calculate Customer Lifetime Value

Most marketing leaders I talk to have their Customer Acquisition Cost (CAC) dialed in.

But that’s only half the story.

Focusing only on the cost to get a customer, without truly knowing what they’re worth, is one of the fastest ways to scale into a loss.

In my 13+ years as a growth marketing strategist, this is the single biggest blind spot I see holding 7-figure businesses back.

It’s like knowing the price of every ingredient but never calculating the total price of the dish you’re selling.

My name is Ian Dionaldo, and I help ambitious companies navigate this exact challenge.

This isn’t just another theoretical article.

This is a hands-on guide built from real-world experience, including helping a tech client transform their funnel to increase customer lifetime value by 35%.

Together, we’re going to walk through how to calculate customer lifetime value accurately, how to use it to make smarter decisions, and how to overcome the common hurdles you’ll face.

TL;DR (Too Long; Didn’t Read)

What it is: Customer Lifetime Value (LTV) is the total net profit you expect from a single customer over their entire relationship with you. Always use profit, not revenue.

Why it matters: It tells you how much you can afford to spend on acquiring a customer (CAC). The goal is a healthy LTV:CAC ratio, with 3:1 being the gold standard for sustainable growth.

How to calculate it: The basic formula is

(Average Revenue Per Customer x Contribution Margin) x Average Customer Lifespan.How to use it: Don’t just calculate one number. Segment your LTV by marketing channel and customer type to find your most profitable areas and make smarter budget decisions.

How LTV Reveals the True Health of Your Business

Before we get into the spreadsheets, we need to build a solid foundation.

Let’s clarify what LTV is and why it’s a critical metric for sustainable growth.

What exactly is Customer Lifetime Value (LTV)?

In the simplest terms, Customer Lifetime Value (LTV or CLV) is the total net profit your company can expect from an average customer over their entire relationship with you.

The most important word in that sentence is profit.

Many people make the mistake of calculating LTV based on revenue, which is dangerously misleading.

A customer might generate $5,000 in revenue, but if your costs to serve them are $5,500, their LTV isn’t just low—it’s negative.

My advice: Always, always use a profit-based LTV.

(And don’t worry about LTV vs. CLV vs. CLTV; in 99% of conversations, they mean the same thing.)

Why is LTV the other half of the CAC equation?

Think of your business as a simple machine.

You put money in one end (Customer Acquisition Cost – CAC).

Over time, money comes out the other end (Customer Lifetime Value – LTV).

The relationship between these two—the LTV:CAC ratio—is the clearest indicator of your business model’s health.

LTV:CAC < 1:1 = You’re on a fast track to going out of business.

LTV:CAC of 1:1 = You’re running on a treadmill, busy but not growing.

LTV:CAC of 3:1 = This is the gold standard. A healthy, sustainable, and scalable model.

LTV:CAC of > 5:1 = You’re highly profitable and likely have an opportunity to invest more aggressively in marketing to grow even faster.

I remember working with a B2B SaaS client who celebrated their low CAC.

But when we calculated their LTV, their ratio was a meager 1.5:1.

That single insight shifted their entire marketing strategy from chasing low-cost leads to attracting high-value, long-term partners.

For more on this, click here to check out our agency’s guide to calculating your CAC.

Historic vs. Predictive LTV: Which one should you use?

Historic LTV is the sum of profits from a customer’s past purchases. It’s accurate but looks backward.

Predictive LTV uses your data to forecast a customer’s future value. It’s more complex but infinitely more powerful for making strategic decisions.

My recommendation is simple: Startups begin with Historic LTV and move to Predictive as soon as they have enough data. Established businesses should be running on Predictive LTV.

How to Calculate Customer Lifetime Value (LTV)

Alright, let’s get practical. This is where we translate the concept into a number you can actually use.

The LTV Formulas: From Quick Glance to Precise Figure

Let’s use a hypothetical SaaS company, “DataStream,” to walk through this.

DataStream’s Key Metrics:

Average Revenue Per Account (ARPA): $200/month

Contribution Margin: 75%

Monthly Customer Churn Rate: 4%

1. The Simple LTV Formula (Revenue-Based)

or DataStream: $200 / 0.04 = $5,000 in lifetime revenue.

2. The Traditional LTV Formula (Profit-Based)

First, find your Average Customer Lifespan:

For DataStream: 1 / 0.04 = 25 months

Now, calculate your profit-based LTV:

For DataStream: ($200 x 0.75) x 25 = $3,750 in lifetime profit.

That’s a $1,250 difference per customer. This is why profit matters.

A Quick Note: What is Contribution Margin?

I mentioned using “Contribution Margin” to calculate profit, and it’s important you know why.

You’ll often hear “Gross Margin” and “Contribution Margin” discussed, but they are not the same.

This is simple, but it can hide costs. It only subtracts the direct cost of making the product.

This is more precise. Variable Costs are any expenses that increase as you sell more or serve more customers.

For E-commerce: This includes COGS, payment processing fees, shipping, and packaging.

For SaaS: This includes hosting fees, data usage, and specific customer support costs tied to each user.

We use Contribution Margin for LTV because it gives you the truest picture of the actual cash generated by each customer. This cash is what’s left over to pay your fixed costs (like salaries and rent) and generate net profit.

[Infographic showing the components of the profit-based LTV formula, now including a callout for Contribution Margin]

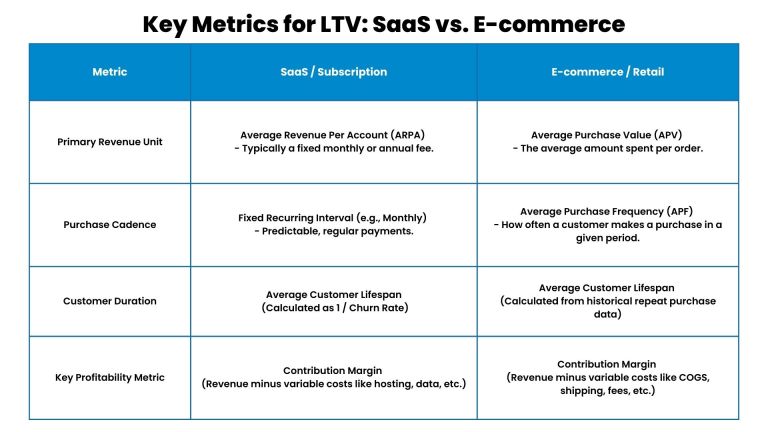

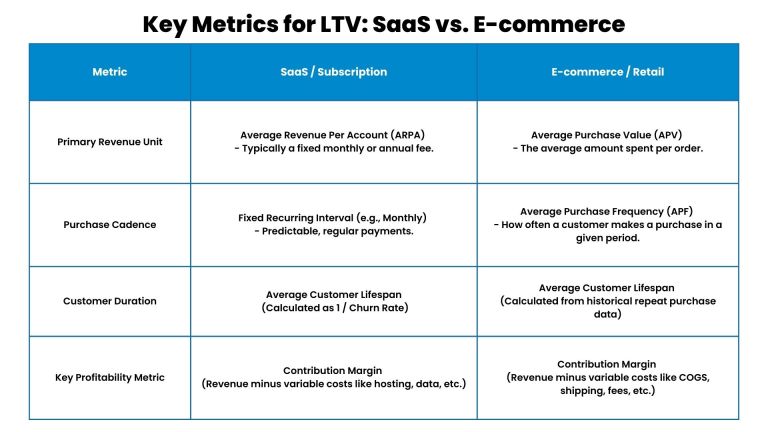

Adapting the LTV Calculation for Your Business Model

The formula needs slight tweaks for different business models.

SaaS/Subscription: The model above is perfect. The key is an accurate churn calculation.

E-commerce: Since purchases are irregular, your formula will use Average Purchase Value (APV) and Average Purchase Frequency (APF).

B2B/Enterprise: You’ll often rely on historic LTV calculated on a cohort basis (e.g., grouping customers by the quarter they signed).

Common Mistakes to Avoid

Using Revenue Instead of Profit: The #1 mistake. It leads to overspending.

Ignoring Segmentation: A single, blended LTV hides the truth.

“Set It and Forget It” Calculation: Re-calculate your LTV at least quarterly.

How to Use LTV to Drive Growth and Profitability

Calculating the number is step one. Using it to grow is where the real value is unlocked.

Segment Your LTV (This Is Where the Gold Is)

A blended LTV is a vanity metric. Actionable insights come from segmentation.

LTV by Marketing Channel: Discover which channels bring in your most profitable customers.

LTV by First Product Purchased: See which products lead to the highest long-term value.

LTV by Persona: Focus your sales and product efforts on your most valuable customer segments.

Set Smarter Budgets and CAC Targets

Your LTV helps you define your CAC Payback Period—the number of months it takes to recoup your acquisition cost.

For most businesses, a payback period of under 12 months is a healthy target.

Based on your LTV, you can set a safe target CAC that ensures a 3:1 LTV:CAC ratio.

Let LTV Guide Your Product and Retention Strategy

Share your LTV data with your product and customer success teams.

Find Your “Sticky” Features: Identify the features that high-LTV customers use most.

Invest in Retention: LTV shows the massive financial impact of small improvements in churn.

Schedule a Free Growth Roadmap Session

It’s a strategic chat, not a sales pitch, designed to give you clarity.

Common LTV Challenges and How to Solve Them

In reality, the data is often messy. Here are the common roadblocks and how to get past them.

“I only have 6-12 months of data.”

This is the classic startup dilemma.

You can’t be perfect, but you can be directionally correct.

Use early cohort retention data as a leading indicator of future LTV.

“My data is in 5 different places.”

Don’t try to boil the ocean.

Start with a simple Google Sheet.

Export a CSV from your payment processor (like Stripe) and your CRM. That’s enough to get a baseline.

As you grow, you can invest in tools that automate this. (For example, check out data platforms like Baremetrics or ChartMogul – add external links here).

“A few ‘whale’ customers are skewing my average LTV.”

This is very common.

Use the median instead of the mean (average).

The median gives you a much more realistic picture of your typical customer’s value.

“LTV feels like it’s based on the past.”

You’re right, it is a lagging indicator.

To make it predictive, watch your newest cohorts.

Is the 30-day retention of new customers trending up or down? That’s your leading indicator.

Final Thoughts: LTV is Your Compass for Growth

Calculating your Customer Lifetime Value is more than just a math exercise.

It’s about fundamentally understanding the health and potential of your business.

Start Today: A messy calculation is better than none.

Focus on Profit: It’s the only way to get a true picture.

Let LTV:CAC Be Your Guide: Aim for that 3:1 gold standard.

Segment Everything: This is where you’ll find your most actionable insights.

Use LTV to Drive Action: Share it across your company to inform marketing, product, and retention strategies.

Mastering your LTV provides the clarity you need to stop guessing and start building a truly scalable and enduring company.

What’s the biggest question you still have about LTV? Share it in the comments below—I’m happy to help.

Jump to...

Join The Growth Engineer's Digest

Get our best, data-backed strategies and frameworks delivered directly to your inbox. No fluff, just proven insights for building your revenue engine.

Stop leaving your growth to chance. The first step to exceeding your potential is a single conversation. Let’s build your roadmap to sustainable success.