- Home

- Data Driven Marketing

- How to Calculate Customer Acquisition Cost (CAC)

How to Calculate Customer Acquisition Cost (CAC): A NO-BS Guide For Marketers and Business Owners

Let’s be honest.

Are you ever looking at your marketing budget and just… guessing?

You’re running ads and seeing new customers sign up, which feels great.

But in those quiet moments, the real questions creep in.

Are we actually making money on these new customers?

Is our markerting campaigns like a well-oiled machine or a ticking time bomb?

If that sounds familiar, I get it. My name is Ian Dionaldo.

For over 13 years, I’ve helped founders answer these tough questions.

The answer almost always starts with one core metric: Customer Acquisition Cost (CAC).

Understanding how to calculate your customer acquisition cost isn’t just for your finance team.

It’s the single most powerful number that tells you if your business is built to last.

Let’s break it down together. No jargon, just a straight-up guide.

TLDR: The 2-Minute Breakdown

The Formula: Customer Acquisition Cost = Total Sales & Marketing Costs ÷ Number of New Customers Acquired.

Include Everything: Don’t just count ad spend. For a true CAC, you must include the salaries of your team, software costs, and commissions.

The Golden Ratio: Your Customer Lifetime Value (LTV) should be at least 3x your CAC. A 3:1 ratio means you have a healthy, sustainable business model.

Go Beyond the Average: Calculate CAC for each marketing channel (Google, SEO, etc.) to discover which ones are actually profitable and which are draining your budget.

What is Customer Acquisition Cost (CAC)?

First things first, let’s define what we’re talking about.

CAC is the total cost of convincing a person to become a paying customer.

It’s your total sales and marketing spend divided by the number of new customers you brought in.

Why CAC is the Most Important Metric You’re Not Tracking

I say this all the time: CAC tells you if your business model is actually viable.

If you spend $500 to get a customer who only pays you $100, you have a very expensive hobby.

Knowing your CAC helps you:

Find Your Real ROI: See which marketing channels are making you money and which are burning it.

Boost Your Profit: Make smart decisions that directly impact your bottom line.

Get Funded: Investors will always ask about your CAC. A clear answer shows you’re a serious founder.

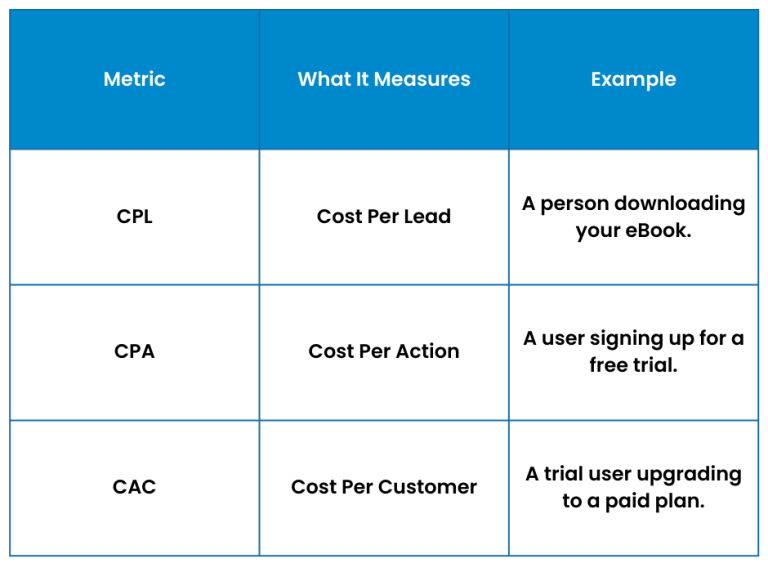

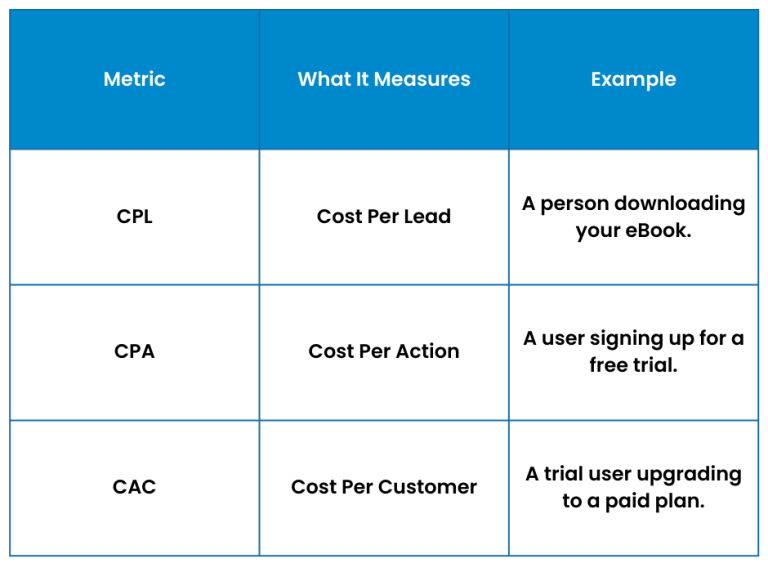

CAC vs. CPA vs. CPL: What’s the Difference?

These terms get mixed up a lot. Let’s make it simple.

Focusing on CAC means you’re focusing on what actually grows your revenue.

How to Calculate Customer Acquisition Cost: A Step-by-Step Guide

This is where the rubber meets the road.

An accurate CAC requires brutal honesty about every dollar you spend.

Step 1: Gather Your Total Sales & Marketing Costs

For a “fully loaded” CAC, you have to include everything.

Ad Spend: Every dollar on Google, Meta, LinkedIn, etc.

Team Salaries: The salaries of your marketing and sales teams.

Commissions & Bonuses: Any performance-based payouts.

Tools & Software: Your CRM, marketing automation, and analytics tools.

Creative & Content: Agency fees, freelance writers, designers, etc.

Step 2: Count Your New Customers (The Right Way)

This part must be precise.

A “new customer” is someone making their first purchase.

If you use a freemium model, you only count them when they upgrade to a paid plan.

Your CRM should be your best friend for separating new customers from returning ones.

The Customer Acquisition Cost Formula

Simple, right? But the real magic is in knowing what to plug into that formula.

For example, if you spent $10,000 on sales and marketing last month and acquired 100 new customers:

CAC=$10,000/100=$100

Your cost to acquire each new customer was $100.

You Have Your CAC… Now What? (Making Your Number Actionable)

Knowing your CAC is step one.

Using it to make smart, strategic decisions is the real goal.

The Golden Ratio: LTV to CAC

Customer Lifetime Value (LTV) is the total revenue you expect from a single customer.

The ratio between LTV and CAC is the ultimate health check for your business.

To Learn More About LTV, read our blog here.

-

1:1 LTV:CAC Ratio: You’re losing money.

-

3:1 LTV:CAC Ratio: This is the gold standard for a profitable, scalable business.

-

4:1+ LTV:CAC Ratio: You’ve built a growth machine. Time to scale.

Blended CAC vs. Paid CAC: Know the Difference

This is a key distinction many founders miss.

Blended CAC includes all your new customers (from paid ads, SEO, word-of-mouth, etc.). It gives you a high-level view of your overall acquisition health.

Paid CAC only includes customers acquired through paid marketing channels. This is the number you use to judge the efficiency of your ad spend.

You need both to see the full picture.

Using CAC for Budgeting and Forecasting

Your CAC is a critical input for your financial model.

If you know your CAC is $100 and you want to acquire 1,000 new customers next year, you can forecast a required budget of at least $100,000.

It moves your budget from a guess to a data-driven investment in growth.

Planning for Scale: Why Your CAC Will Likely Increase

Here’s a hard truth: as you scale, your CAC often goes up.

Why? Because you first capture the easiest-to-reach customers.

To get the next batch, you have to spend more, enter more competitive channels, and fight harder for attention.

Acknowledge this in your forecasts. The key to managing it is to constantly optimize your funnel and diversify into more efficient channels, like SEO and content marketing.

Common CAC Questions & Pitfalls (And How to Avoid Them)

I’ve seen smart founders get tripped up by the same issues. Let’s tackle them head-on.

“How do I handle a long sales cycle? My Q1 spend brings in Q2 customers.”

This is a classic attribution problem.

The best practice is to align the costs with the period the customer was acquired.

So, if you know a customer who closed in April was nurtured by a marketing campaign in February, you need an attribution model that gives credit (and cost) to that earlier touchpoint.

This is where moving beyond simple “last-click” attribution becomes essential. Look into linear or U-shaped attribution models in your analytics.

“My data is siloed across five different platforms!”

You’re not alone. The best fix is to make your CRM the single source of truth.

Take the time to integrate your ad platforms and financial software with it.

It’s a pain upfront, but it pays for itself in clarity.

Here’s a guide on how to break data silos.

In my 13 years as Growth and Performance marketer, here are common CAC Calculation mistakes are:

-

Mistake #1: Ignoring salaries and tool costs. Your CAC will look great, but it won’t be real. Include everything.

-

Mistake #2: Using a monthly CAC for a long sales cycle. If your sales cycle is 6 months, calculate CAC quarterly or annually.

-

Mistake #3: Mixing new and returning customers. This will artificially lower your CAC. Use your CRM to segment them.

-

Mistake #4: Freaking out about a high CAC in a new company. It’s normal! Focus on the LTV:CAC ratio and your plan to optimize over time.

“We’re a startup and our CAC is terrifyingly high!”

Relax. This is normal.

Early on, you’re experimenting and learning.

When you talk to investors, frame the conversation around your LTV:CAC ratio and your clear, data-backed plan to optimize CAC over time.

Show them you’re focused on acquiring valuable customers, not just cheap ones.

our Final Takeaway

Mastering your CAC is about turning guesswork into a predictable growth plan.

It’s about building a business with confidence.

You know that every dollar you spend is an investment in a profitable future.

Now, I want to hear from you.

What’s the single biggest challenge you face when you try to calculate customer acquisition cost?

Let’s talk about it in the comments below. I’m here to help.

Jump to...

Join The Growth Engineer's Digest

Get our best, data-backed strategies and frameworks delivered directly to your inbox. No fluff, just proven insights for building your revenue engine.

Stop leaving your growth to chance. The first step to exceeding your potential is a single conversation. Let’s build your roadmap to sustainable success.